- Investors

- Solteq as an investment

- Share & shareholders

- Releases & publications

- Governance

- Governance principles

- General meeting

- Board of Directors

- CEO and executive team

- Insiders and insider register

- Remuneration and incentives

- Shareholders' Nomination Committee

- Internal control and risk management

- Code of Conduct

- Notifications of managers’ transactions

- Auditors

- Articles of association

- Disclosure Policy

CEO's review

2025: Result Improvement Continued Despite Diminishing Revenue

Annual Report 2025

The year 2025 was a demanding one for the company, as the market environment and customer demand remained subdued. The comparable revenue for the financial year amounted to EUR 46.7 million (48.8). In the fourth quarter, however, the Group’s comparable revenue improved year-on-year for the first time in eight quarters, driven by growth in the Utilities business, in particular. The Group’s comparable operating result amounted to EUR 0.8 million (0.4), reflecting the impact of continuous efficiency and cost-savings measures. Overall, the financial performance for the review period remained below expectations, and the company issued a profit warning in December 2025.

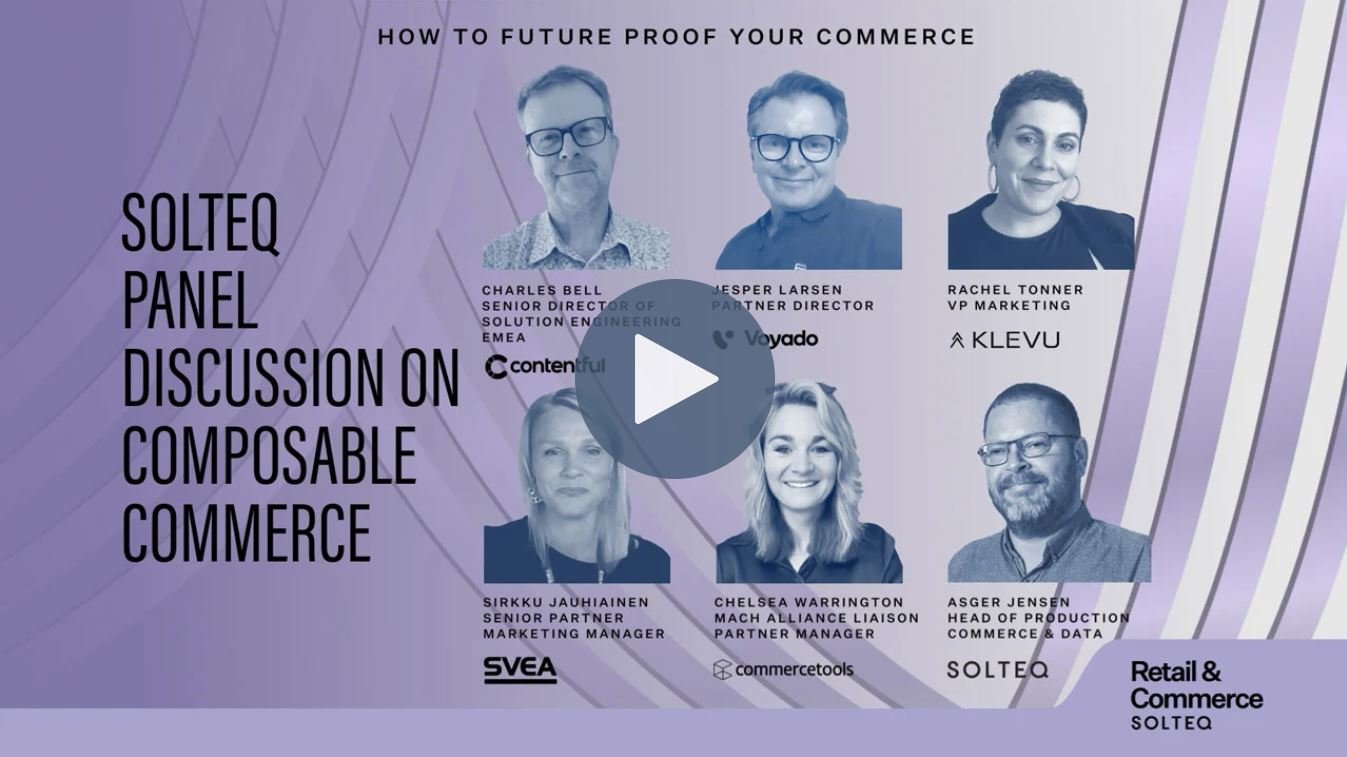

The Retail & Commerce segment’s comparable revenue for the financial year amounted to EUR 34.9 million (36.6). Market conditions and delays in investment decisions for new customer engagements constrained the segment’s growth. The segment’s comparable operating result for the financial year amounted to EUR 2.8 million (2.2).

The Utilities segment's financial performance was weighed down by a low utilization rate in the consulting business, which continued for the first three quarters. The segment’s comparable revenue for the financial year amounted to EUR 11.8 million (12.2), and the comparable operating result was EUR -2.0 million (-1.8). Investments in product development continued throughout the financial year, and new software solutions will be introduced to the market in phases during 2026.

The operating environment of the Retail & Commerce segment is expected to remain subdued during the current financial year. The outlook for the Utilities segment remains moderate, as regulatory and market practice changes drive demand for new IT solutions amid ongoing customer market consolidation. The company continues its long-term efforts to strengthen its offering, competitiveness, and customer value.

CEO Aarne Aktan

Investor news

Receive latest investor related releases and news as they are published.